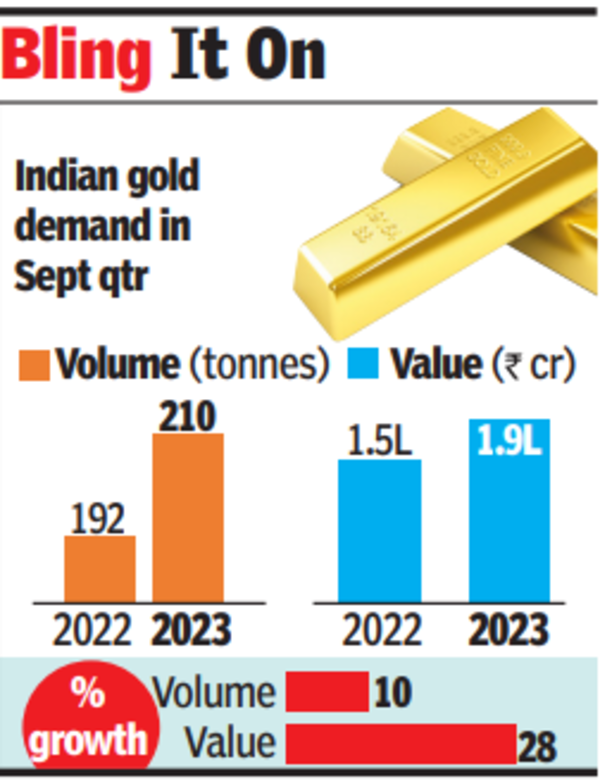

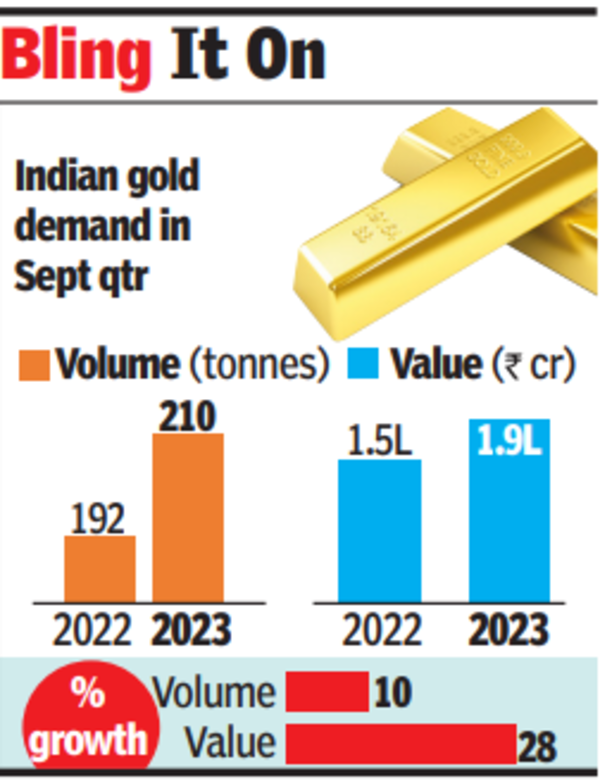

CHENNAI: Indian gold demand went up by 10% at 210.2 tonne in the July-September period as against 191.7 tonne a year ago. In value terms, India’s Q3 2023 demand was Rs 1,88,400 crore, up by 28% as compared to Q3 2022 (Rs 1,47,220 crore), according to data from the World Gold Council (WGC) released on Tuesday.

Total jewellery demand in India for Q3 2023 was up by 7% at 155.7 tonne as compared to Q3 2022 (146.2 tonne).In value terms, it was 1,39,550 crore – an increase of 24% when compared to Rs 1,12,330 crore in Q3 2022.

“Purchase of gold jewellery in India was up 7% y-o-y, aided by softer gold prices and festive demand, more pronounced in South India,” said Somasundaram P R, regional CEO, India, WGC. He, however, did not elaborate on how much the south contributed to overall demand growth in the country.

Investment demand for gold went up by 20% at 54.5 tonne in July-September. “Investment gold demand (bars and coins) jumped 20%. Price correction was a major factor that triggered the latent demand, which we believe continues to be underpinned by strong positive economic sentiment mixed with uncertainties from a variety of factors,” Somasundaram added.

Total jewellery demand in India for Q3 2023 was up by 7% at 155.7 tonne as compared to Q3 2022 (146.2 tonne).In value terms, it was 1,39,550 crore – an increase of 24% when compared to Rs 1,12,330 crore in Q3 2022.

“Purchase of gold jewellery in India was up 7% y-o-y, aided by softer gold prices and festive demand, more pronounced in South India,” said Somasundaram P R, regional CEO, India, WGC. He, however, did not elaborate on how much the south contributed to overall demand growth in the country.

Investment demand for gold went up by 20% at 54.5 tonne in July-September. “Investment gold demand (bars and coins) jumped 20%. Price correction was a major factor that triggered the latent demand, which we believe continues to be underpinned by strong positive economic sentiment mixed with uncertainties from a variety of factors,” Somasundaram added.

Source link